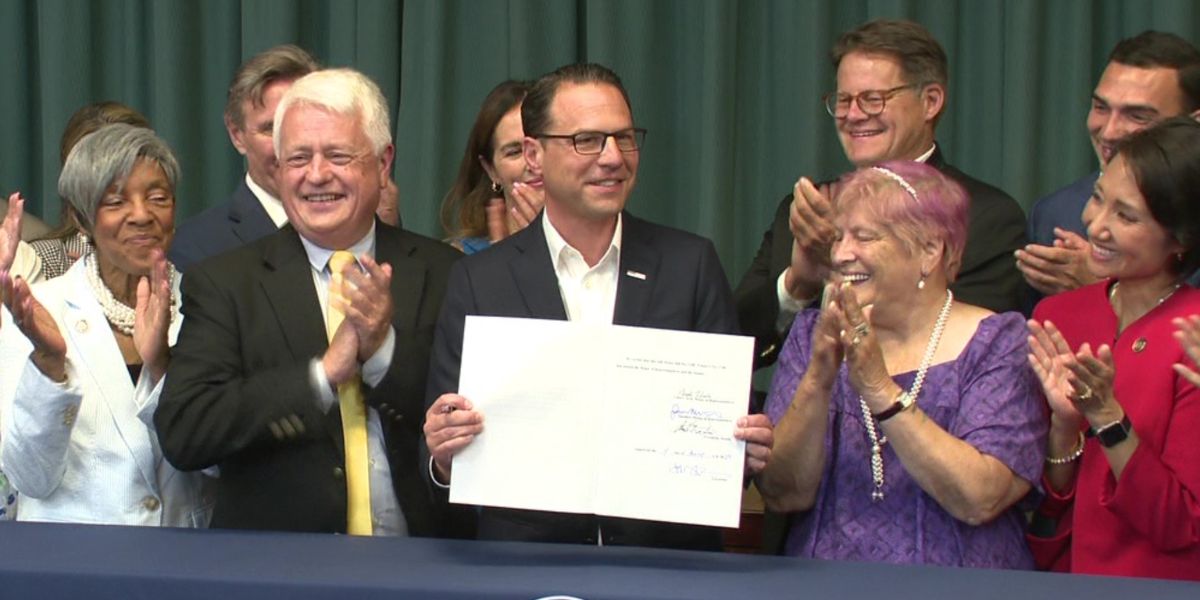

Pennsylvania has launched a ground-breaking program providing free assistance for property tax and rent rebate applications in an effort to lessen financial constraints and provide equitable access to important benefits.

For those who are struggling to pay for housing, especially those who are experiencing financial difficulties or are having difficulty navigating the application process, this program is an invaluable lifesaver.

The following are this initiative’s five key components:

1. Inclusivity and Accessibility:

Pennsylvania’s move to offer free help with rent rebate and property tax applications shows that the state is committed to these two goals.

The state hopes to assist those who could encounter obstacles to participation—older persons, people with low means, or people with limited computer proficiency—by providing practical support. This program guarantees that all qualified citizens, regardless of their situation, have equal access to the financial assistance to which they are entitled.

2. Streamlined Application procedure:

Simplifying the application procedure is one of the free help program’s main advantages. Applicants will be guided through each step of the process by trained volunteers and community organizations, which will streamline the procedure and reduce confusion or mistakes.

Pennsylvania hopes to increase participation and guarantee that qualified persons receive the support they require by offering individualized assistance to make the application process easier and less intimidating for residents.

3. Maximizing reimbursement Amounts:

Targeting the highest possible reimbursement amounts for qualified applicants is a key component of the program. Trained volunteers will make sure that applicants receive the greatest amount of the rebate and assist them in gathering the required paperwork.

Residents can manage complicated eligibility requirements and maximize their benefits with the support of this individualized assistance, which is priceless. Pennsylvania wants to aid individuals in need by offering substantial financial relief and easing the strain of housing expenditures by optimizing rebate amounts.

4. Community Engagement and Outreach:

To spread knowledge about the program and connect with eligible citizens, Pennsylvania’s plan entails extensive community engagement and outreach. In order to spread knowledge, hold outreach activities, and establish connections with locals who might benefit from the program, community organizations, regional agencies, and volunteers are essential.

Pennsylvania guarantees that those most in need of its assistance program receive it by interacting with communities at the grassroots level, which also promotes a feeling of community solidarity and support.

5. Dedicated to Equity and Social Justice:

The fundamental principle of Pennsylvania’s program is its dedication to equity and social justice. The state acknowledges that vulnerable people are disproportionately affected by housing expenses and is working to overcome structural barriers to access by providing free support for property tax and rent rebate applications.

This endeavor is consistent with larger campaigns to uphold economic justice, lessen inequality, and guarantee that every locality member has the chance to prosper.

In Conclusion

Pennsylvania’s move to provide rent rebates and property tax applications with free help is a big step in the right direction toward providing citizens with the necessary support.

Pennsylvania shows its commitment to meeting the needs of all citizens by putting accessibility first, optimizing rebate amounts, expediting the application process, involving communities, and respecting the values of fairness and social justice. This project not only offers quick cash assistance but also promotes a more resilient and inclusive community where everyone may prosper.